Quicken – Intuitive and Fast

By Wayne Maruna

Let’s face it.

People are either good at math or they aren’t. It’s fairly easy to discern

those who are bad at math. You’ll find them queuing up to buy lottery tickets.

Functioning as an adult in our society pretty much dictates that one have a checking account. If a person has a checking account and is bad at math, unfortunate things are likely to occur. Banks count on it and their fee structures reflect it, with penalties for things like overdrawn accounts and late payments.

For those who have checking accounts and are bad at math but reasonably comfortable with computers, there is hope. For those who have checking accounts, are bad at math and clueless around computers….well, they’re either going to have to lean hard on a close relative or get to know their personal banker really well.

The hope comes in the form of personal financial software, where Quicken rules the roost like few other software titles in any genre. The only legitimate contender over the years has been Microsoft Money, but even Microsoft folded their tent and discontinued their offering. A few alternates exist on the periphery, including free programs like GnuCash, Grisbi, and HomeBank, but Quicken remains the proverbial 800 pound gorilla.

In The Beginning

Quicken was the first product of a company named Intuit, started in the mid-80s by Tom Proulx, a computer science major, and Scott Cook, a former marketing manager at Proctor & Gamble. The two met by chance outside the Stanford University Library where Cook was posting flyers seeking a code developer to help him realize his vision of a software program that would help people automate their finances. The name Intuit derives from the word ‘intuitive’, as the goal was to make the tedious and difficult chore of paying monthly bills easy. The name ‘Quicken’ came from a thesaurus as a synonym for ‘fast’. By 2006, more people were buying Quicken than all other personal finance software combined.

The key to Quicken’s growth was its visual familiarity – it was designed to look just like a standard paper check register, except on a computer screen, and without White Out or scratch-throughs, and with – Hallelujah! – accurate computations. Its original goal was to facilitate writing checks and recording transactions into an electronic check register, and then to ease the monthly chore of reconciling the check register balance to the monthly bank statement.

Expanded Capabilities

Over time, Quicken expanded to keep up with the growth in electronic banking, adding bill paying, investment tracking, transaction downloading, and graphical reporting capabilities. Today there are several versions of the program tailored to user needs, including Quicken Starter Edition 2012 ($30), Quicken Deluxe ($50), Quicken Premier ($70), Quicken Home and Business ($80), and Quicken Rental Property Manager ($120). Intuit also offers small business software called QuickBooks which has another collection of versions which can include payroll functions. Intuit is also the company behind TurboTax, which flies off store shelves during tax filing season.

I’ve been using Quicken since the ‘90s when, as a volunteer church treasurer, I initially used it to facilitate check writing. Though Quicken seems to issue a new version every year and would like very much for us to enhance their revenue streams accordingly, my main home computer is still running Quicken Basic 2004. I can get away with that old version because I don’t electronically communicate with my banks from within Quicken. Truthfully, I’m still sort of stuck in the 1990s, using Quicken to mirror my paper check registers, which not only keeps me accurate, but also makes reconciliations a breeze. I can also set up recurring expenses which are automatically deducted from my accounts – one less thing to worry about forgetting.

Not for Everybody

Though Quicken owns the lion’s share of the personal finance software market, I would guess that of all the client machines I have worked on, fewer than 15% have Quicken installed. A recent survey of the members of the New Bern Computer User Group asked whether and how they used personal finance software. The breadth of responses revealed the way in which Quicken can be customized for personal use depending on need.

Out of about 130 members, responses were received from 20 people, only eight of whom used Quicken, so we’re talking about a fairly small sample size. No one reported using a competing program. Six of those who did not use Quicken built their own financial tracking systems in a spreadsheet program like Excel. Of course, if you’re comfortable building a spreadsheet to handle revenues and expenses, you’re likely better at math than the average person, and hence would not gain as much from specialized software. The remaining six respondents felt their financial situations did not warrant having specialized software, choosing to get by with their paper check registers, calculators, and the occasional application of White Out.

Feature Usage Varies Greatly

For those using Quicken, everyone surveyed uses the electronic check register and the account reconciliation process. In this day of electronic payments, very few still bother to print checks out of the program, and not many use the bill pay process within the program, preferring to use their bank’s electronic bill pay system or have bank draft arrangements with their payees. Better than half the respondents use Quicken to download transactions from their banks, investments, and even their credit card transactions. About half bother to categorize their expenditures (utilities, auto, groceries, travel, etc.) and use the reporting function to summarize results. Almost no one uses the program’s budgeting option. Most use the automated recurring transaction list to transact regular monthly postings to the register.

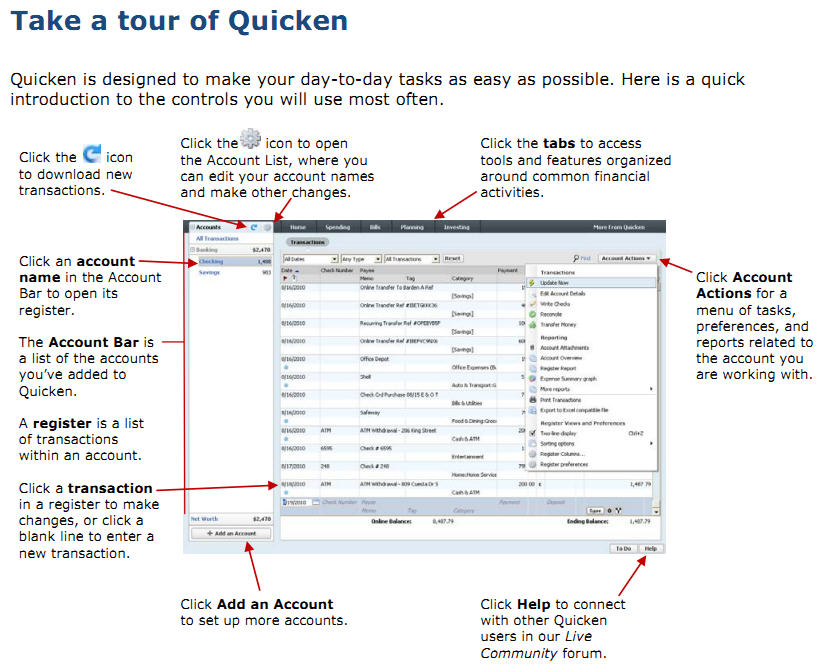

The wide variation in the way people use the program attests to its flexibility. Each user has their own level of understanding, degree of financial complexity, and willingness to learn the capabilities of the program. Quicken is designed to accommodate each user’s unique set of circumstances. If you find keeping your financial records straight a challenge, Quicken, or one of its alternatives, might be worth investigating. You can start here: http://quicken.intuit.com/