Exploring Gnucash

By Wayne Maruna

I wrote about Quicken, the leading personal financial software package, in the March, 2012 issue of the Taberna Tribune. ( http://pages.suddenlink.net/wamaruna/Quicken.html ). Quicken is a very good program but it is not free. Current on-line pricing is in the range of $40 for the most popular versions. As I briefly mentioned in that article, there are a handful of programs that perform similar tasks. I decided to check out one of them, a free program called Gnucash (pronounced with a hard ‘G’.)

Gnucash is available for use on Windows, Mac OS X, and Linux machines. For Windows, it works on XP, Vista, Windows 7 and 8. It can be downloaded from www.gnucash.org.

I use Quicken to track my own bank accounts, but I have been curious about Gnucash for quite some time. When my mother-in-law (MIL) moved up from Florida early this year and I took on the job of handling her finances, it seemed like a good opportunity to install Gnucash and see how it compared to Quicken. Once I got past the initial learning curve, the results have proven positive and the program fulfills my simple requirement of serving as an electronic check register for her various checking and saving accounts. The Gnucash website describes the software as follows:

“GnuCash is personal and small-business financial-accounting software … designed to be easy to use, yet powerful and flexible. Gnucash allows you to track bank accounts, stocks, income and expenses. As quick and intuitive to use as a checkbook register, it is based on professional accounting principles to ensure balanced books and accurate reports.”

It is easy to be intimidated by Gnucash at first. Just the mention of

professional accounting principles will send many readers scurrying to the

exits. Others will be scared away by the overwhelming amount of documentation

Gnucash provides in the form of a 159 page help manual and a 223 page Tutorial

and Concepts Guide. Before you say “Forget that!” be aware that all that

documentation is there to answer any questions that might arise due to the broad

array of available features, most of which the average user won’t need. I only

had to dig into the documentation for a couple of things, including how to

perform a check reconciliation, but I will grant you that I am a retired

accountant who has also been a Quicken user since 1998, so I am not a novice

user.

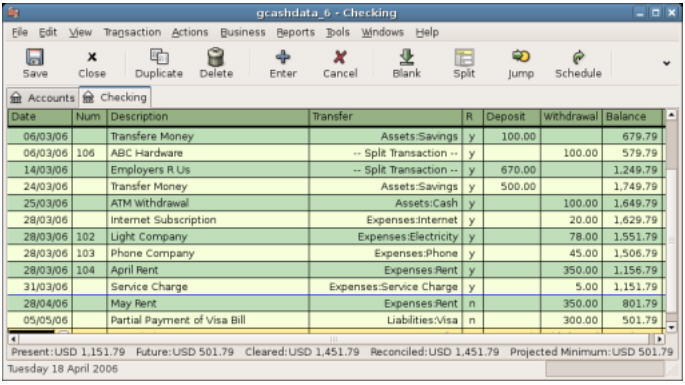

When you open the program, the first thing you do is set up your accounts, which basically means giving them a name and entering an opening balance. A major difference between Quicken and Gnucash is that Gnucash requires you to categorize your entries. For example, an entry for City of New Bern Utilities could be categorized as Expense – Utilites. Since I don’t much care about categorizing my MIL’s entries, most deposits get entered as Income – Misc. and most outflows get entered as Expenses – Misc. If you want to track and summarize your expenditures by category, you certainly have that capability, and you can add categories as desired. The program will also accommodate split transactions, meaning allocating an outlay to multiple categories.

The basic interface is that of a check register. You can choose a single-line entry view showing the basics like check number, date, payee, category, and amount, but I prefer a two-line view which allows me to annotate entries if I wish. For example, on a check sent to one of the grandkids which gets categorized as ‘Expenses – Gifts’, I may enter a second line note stating ‘Valentine gift’.

For accounts with limited entries, like a savings account, I’m relying solely on

Gnucash to record and save account activity. For my MIL’s main checking account,

I still keep a paper register. Entering the data into Gnucash allows me to make

sure I have not made any math errors in the paper register, since the balance in

Gnucash should match the paper register. When I exit the program, it reminds me

to save the file; saving is not automatic like it is in Quicken. When you save

the data file, it does not overwrite the prior data file but retains it for 30

days. I make a point of not only saving the latest data file, but backing it up

as well to a flash drive.

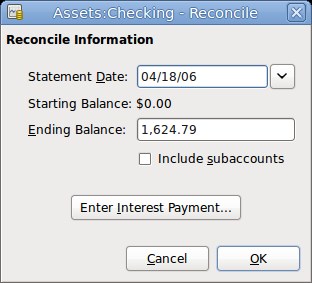

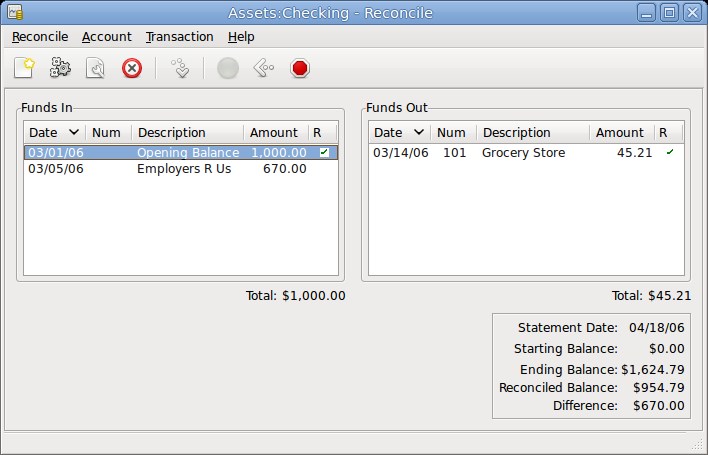

Where Gnucash (or Quicken) really helps me is when it comes time to balance the account to the monthly bank statement. I go into the check reconciliation view and check off items listed on the bank statement. When everything from the statement is checked, I should show a net difference of zero, and I am done. If the net is not zero, then I either entered something wrong or omitted an entry, and it’s time to go hunting.

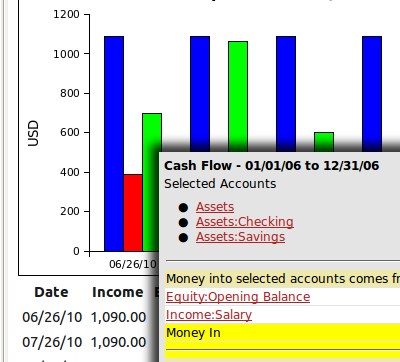

There are a multitude of available standard reports and graphs if you are so inclined.

If

you are a Quicken user and want to try importing your data into Gnucash to try

it out, Gnucash will import standard Quicken *.QIF files. Conversely, one can

also export a Gnucash file to Quicken using a utility called GnucashToQIF.

Overall, I would say that Gnucash is perhaps not as polished as Quicken in terms

of its user interface, but that might just be due to my familiarity with

Quicken. It is an accurate and efficient way to track bank accounts, credit

cards, and investments, and since it is ‘open source’ software (meaning totally

free), it represents a great bargain. It costs nothing to try other than an

investment of time.

One of my favorite tech writers, Jack Wallen, who writes for TechRepublic, says Gnucash is not only a viable alternative for Quicken, but also for its expensive ($175 and up) big brother, QuickBooks, which many small businesses rely on for their accounting software. You can read more here:

http://www.techrepublic.com/blog/doityourself-it-guy/diy-accounting-on-a-shoestring-budget-with-gnucash/157